does instacart take out taxes for shoppers

3015 reviews from Instacart Shoppers employees. This stuff applies just as much for Instacart Uber Eats Grubhub Postmates.

Instacart Shoppers Can Now Choose To Be Real Employees Wired

But if you choose to work as an Instacart full-service shopper.

. Depending on your working relationship with Instacart. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. Form 1099-NEC is a new name for Form 1099-MISC.

You visit stores for example Whole Foods Costco and other participating nearby. The rate from January 1 to June 30 2022 is 585 cents per mile. Taxes are required on the money you earn as a shopper just like any other type of income.

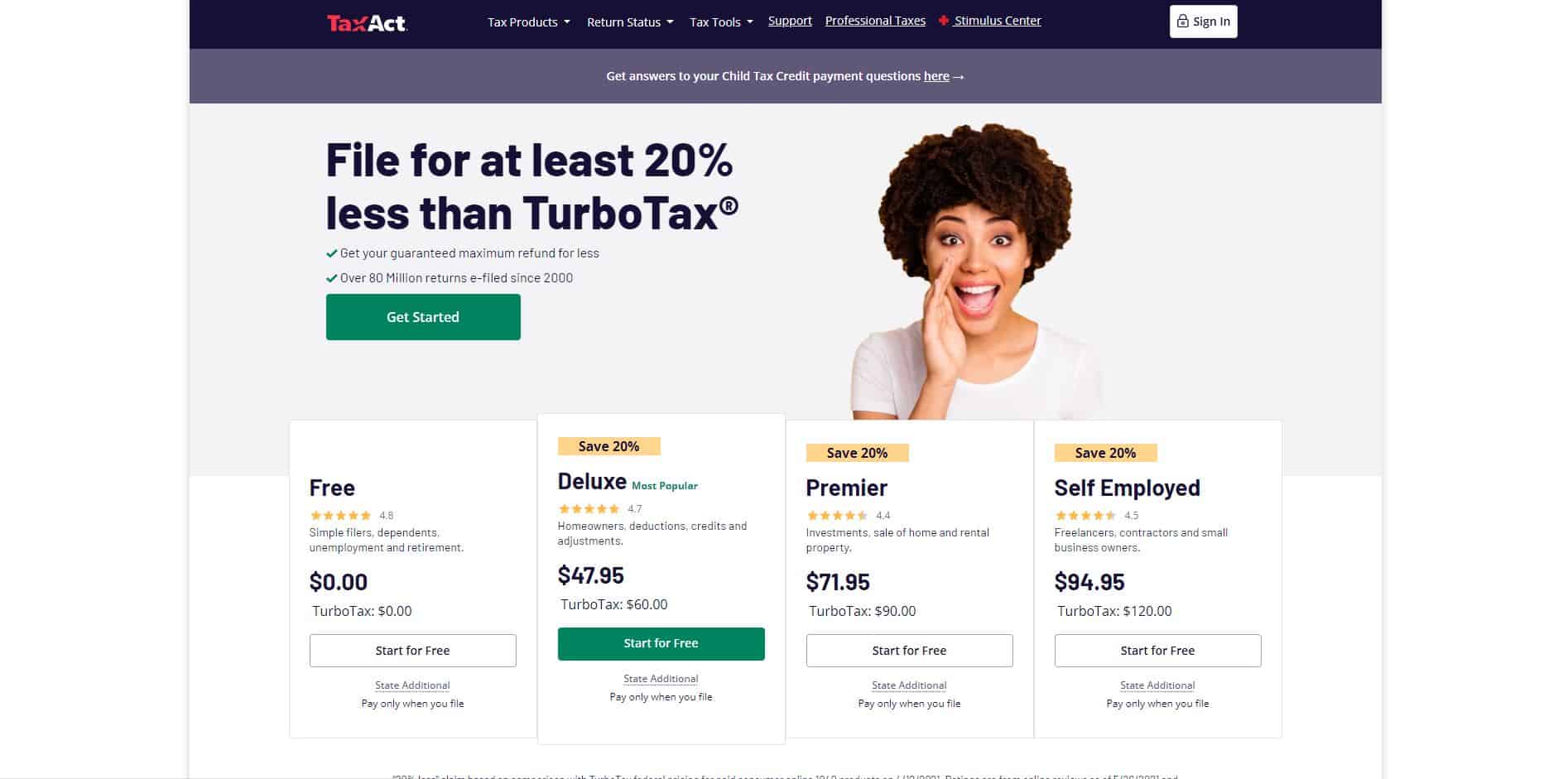

In 2022 you can deduct a fixed amount of 585 cents per mile while the rate for 2021 was 56 cents per mile. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. To actually file your Instacart taxes.

Top Instacart Tax Deductions. Instacart recommends a 5 tip which is much less than the average 15 restaurant tip. Does Instacart take taxes out.

Instacart Shoppers weve put together. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. For tax purposes theyll be treated the same as anyone working a traditional 9-to-5.

Only Customers shopping in Oklahoma with a 100 disabled veteran sales tax exemption card issued by the Oklahoma Tax Commission can contact Instacart Care to request a sales. The short answer is no if youre an Instacart full-time shopper. To make saving for taxes easier consider.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. No taxes are taken out of your Doordash paycheck. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

However Instacart will automatically take out your taxes if youre an in-store shopper. As an Instacart driver you make cash by delivering staple goods to your clients home. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. Whatever your experience with Instacart you should know what to expect when it comes to taxes. You do a combination of in-store shopping and delivering those goods to customers.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. Instacarts official name is Instacart other delivery companies use different legal names. Everyone out there serving for.

Please make any changes by January 15 and reach out to Instacart. In-store and delivery shoppers. The average base pay for an Instacart in-store shopper is about 13 per hour.

Yes - in the US everyone who makes income pays taxes. This means that you have to cover all your own. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits.

Do Instacart take out taxes. In-store shoppers are classified as Instacart employees. What kind of mileage can I deduct.

You can find this in your shopper account or keep records in your own bookkeeping app. As an Instacart shopper here are seven deductions you should definitely be tracking. Taxes for in-store shoppers.

Does Instacart Take out Taxes. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

What You Need To Know About Instacart 1099 Taxes

How To File Your Taxes As A Food Delivery Driver Grubhub Doordash Instacart Dumpling Etc Contact Free Taxes

How To File Taxes As An Instacart Shopper Final Week Of Instacart Before Bell Was Born Youtube

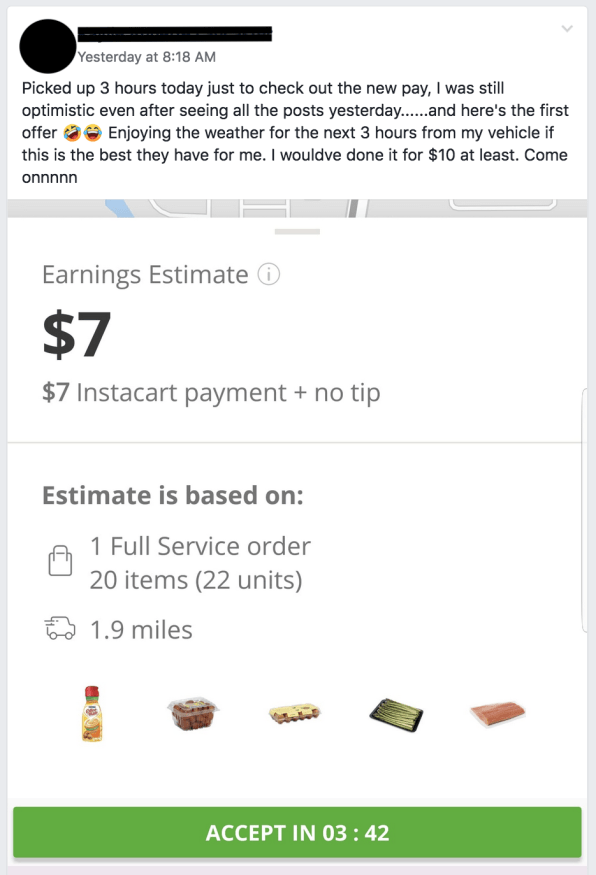

Instacart Drivers Say This Data Proves They Re Still Being Underpaid

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Q A 2020 Taxes Tips And More Youtube

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

How To Make Money As An Instacart Shopper Nerdwallet

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

How Much Do Instacart Shoppers Make The Stuff You Need To Know

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How To Work For Instacart What You Need To Know Rocket Resume

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

How Much Does Instacart Pay In 2022 Ridester Com

Being An Efficient Instacart Shopper Some Tips

Instacart Driver Review 10k As A Part Time Instacart Shopper